A Biased View of Home Owners Insurance In Toccoa Ga

Wiki Article

Unknown Facts About Health Insurance In Toccoa Ga

Table of ContentsOur Final Expense In Toccoa Ga DiariesAn Unbiased View of Commercial Insurance In Toccoa GaThe Health Insurance In Toccoa Ga PDFsAn Unbiased View of Annuities In Toccoa Ga

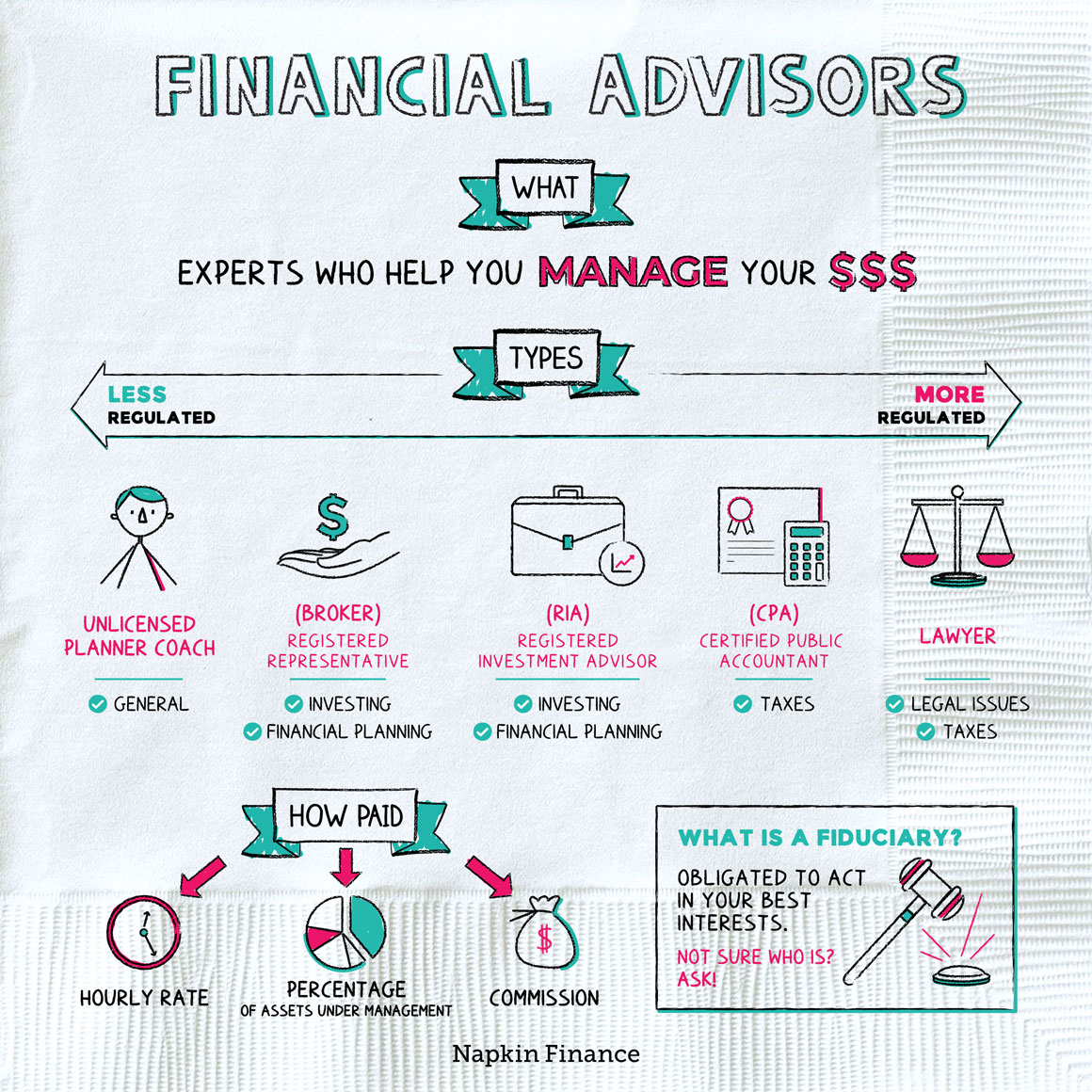

A monetary consultant can likewise assist you choose exactly how best to achieve objectives like conserving for your kid's college education and learning or paying off your debt. Although monetary experts are not as well-versed in tax law as an accounting professional may be, they can provide some support in the tax planning process.Some economic consultants use estate preparation solutions to their customers. They could be learnt estate planning, or they might wish to deal with your estate attorney to answer inquiries about life insurance policy, counts on and what need to be done with your financial investments after you die. It's important for financial experts to remain up to date with the market, financial conditions and consultatory best practices.

To market financial investment items, advisors need to pass the relevant Financial Market Regulatory Authority-administered tests such as the SIE or Collection 6 examinations to acquire their accreditation. Advisors that desire to sell annuities or various other insurance policy products need to have a state insurance policy permit in the state in which they plan to sell them.

The Definitive Guide for Automobile Insurance In Toccoa Ga

You employ a consultant that charges you 0. Since of the common cost framework, several experts will certainly not work with customers who have under $1 million in assets to be taken care of.Investors with smaller profiles may look for out a financial advisor who bills a per hour fee rather than a portion of AUM. Per hour charges for experts usually run between $200 and $400 an hour. The more complex your monetary circumstance is, the more time your consultant will need to commit to handling your properties, making it much more pricey.

Advisors are experienced experts that can assist you establish a plan for monetary success and implement it. You might also consider reaching out to an advisor if your personal financial situations have actually lately come to be much more difficult. This can imply getting a house, getting wedded, having children or obtaining a huge inheritance.

Not known Details About Automobile Insurance In Toccoa Ga

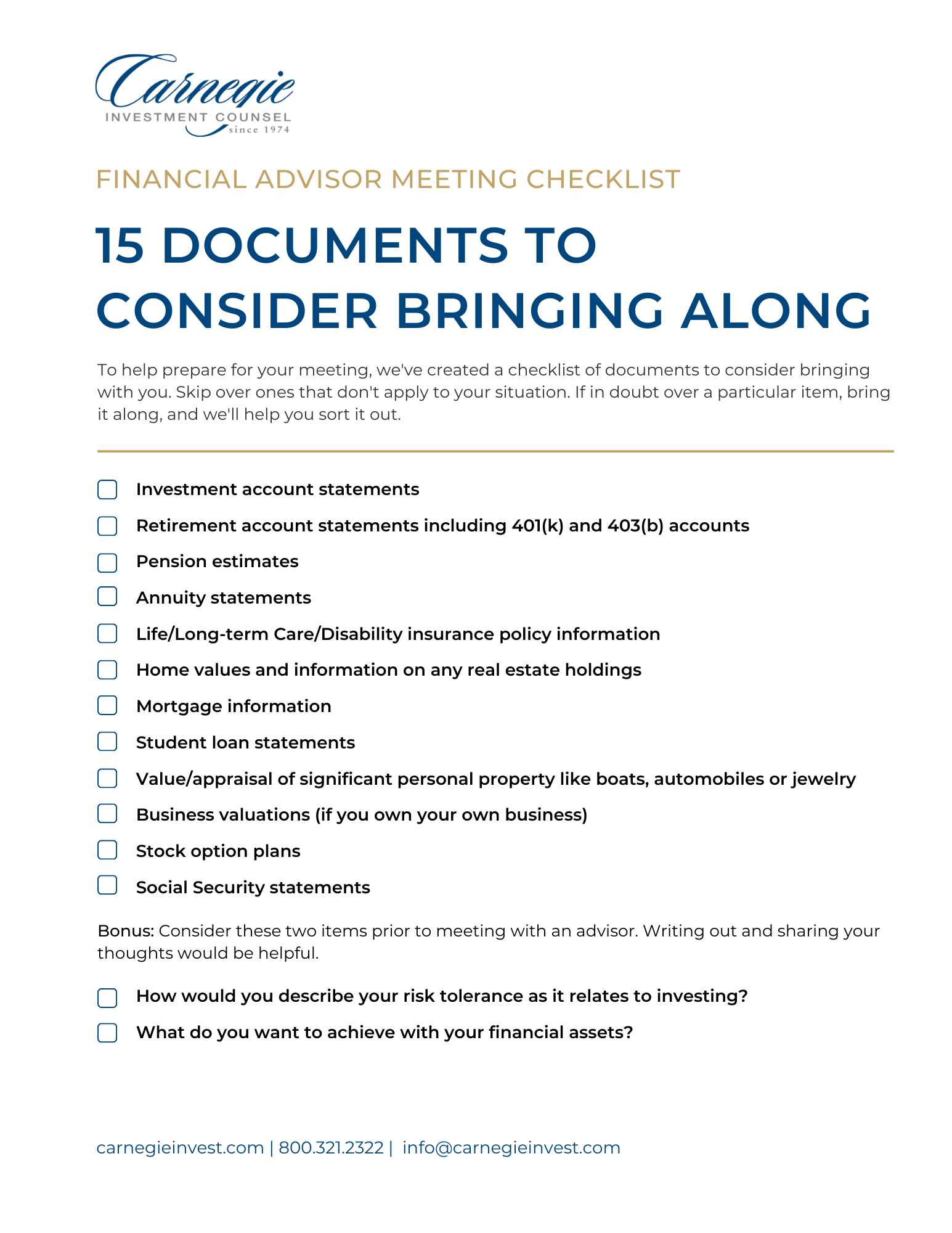

Prior to you meet the advisor for a preliminary consultation, consider what solutions are most essential to you. Older grownups might require help with retirement planning, while younger grownups (Affordable Care Act (ACA) in Toccoa, GA) may be trying to find the finest method to invest an inheritance or starting a company. You'll want to seek an expert that has experience with the solutions you desire.The length of time have you been advising? What service were you in before you entered financial suggesting? That makes up your typical customer base? Can you give me with names of a few of your clients so I can review your solutions with them? Will I be collaborating with you directly or with an associate advisor? You may likewise want to take a look at some sample economic plans from the expert.

If all the examples you're provided coincide or similar, it may be an indicator that this advisor does not properly customize their suggestions for each customer. There are 3 major sorts of economic advising specialists: Certified Monetary Organizer experts, Chartered Financial Experts and Personal Financial Specialists - https://allmyfaves.com/jstinsurance1?tab=jstinsurance1. The Licensed Financial Organizer specialist (CFP specialist) accreditation indicates that a consultant has satisfied a professional and moral requirement set by the CFP Board

The Basic Principles Of Home Owners Insurance In Toccoa Ga

When choosing a monetary advisor, take into consideration someone with a specialist credential like a CFP or CFA - https://www.huntingnet.com/forum/members/jstinsurance1.html. You may additionally consider an expert that has experience in the solutions that are most essential to youThese advisors are normally filled with disputes of rate of interest they're a lot more salesmen than consultants. That's why it's essential that you have a consultant who works only in your benefit. If you're looking for an expert that can really supply real value to you, it is very important to look into a variety of potential alternatives, not merely choose the given image source name that advertises to you.

Currently, many consultants have to act in your "best interest," however what that requires can be almost unenforceable, except in the most outright cases. You'll need to locate an actual fiduciary.

"They must confirm it to you by showing they have actually taken major ongoing training in retired life tax and estate preparation," he says. "You must not spend with any kind of expert who doesn't invest in their education.

Report this wiki page